Should You Invest in an Investment Property in 2024?

Reading time: 4 minutes

Investing in property is a long-term decision. Real estate is an illiquid asset, and the focus should be on long-term potential rather than short-term capital or rental returns over the next few years. The dynamics of property investments are influenced by broader factors such as demographics and the overall Australian economy over the long term. This blog delves into key factors affecting the market in the medium term.

Supply and Demand Imbalance

The balance between housing supply and demand is a key determinant of property prices. Oversupply tends to soften prices, while undersupply drives them up.

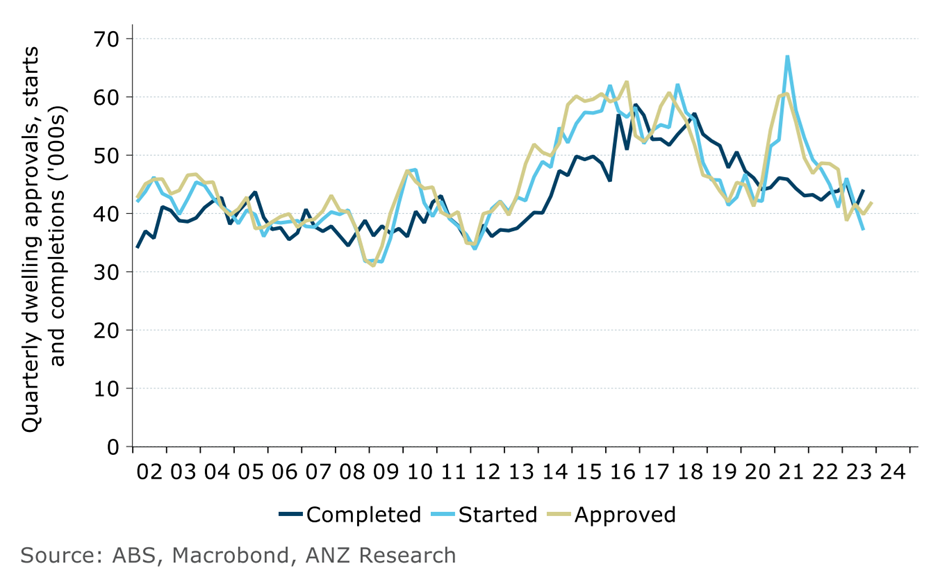

In August 2023, the National Cabinet set an aspirational goal of delivering 1.2 million new dwellings over five years, starting mid-2024. That translates to 240,000 homes annually, or 60,000 per quarter. However, while building approvals have occasionally hit 60,000 per quarter, completions haven't reached that figure in the past two decades.

Building starts and completions

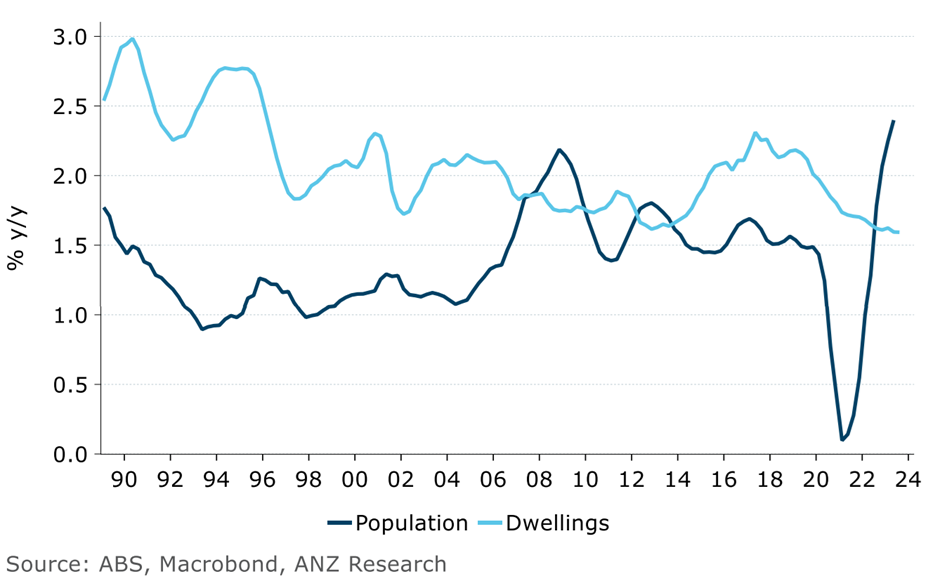

Despite the targets, current supply levels are unlikely to meet the aspirational goals. At the same time, population growth has rebounded since the downturn during COVID-19. The combination of a declining rate of new dwelling growth and an increasing population has exacerbated the ongoing housing crisis.

Population growth vs dwelling growth

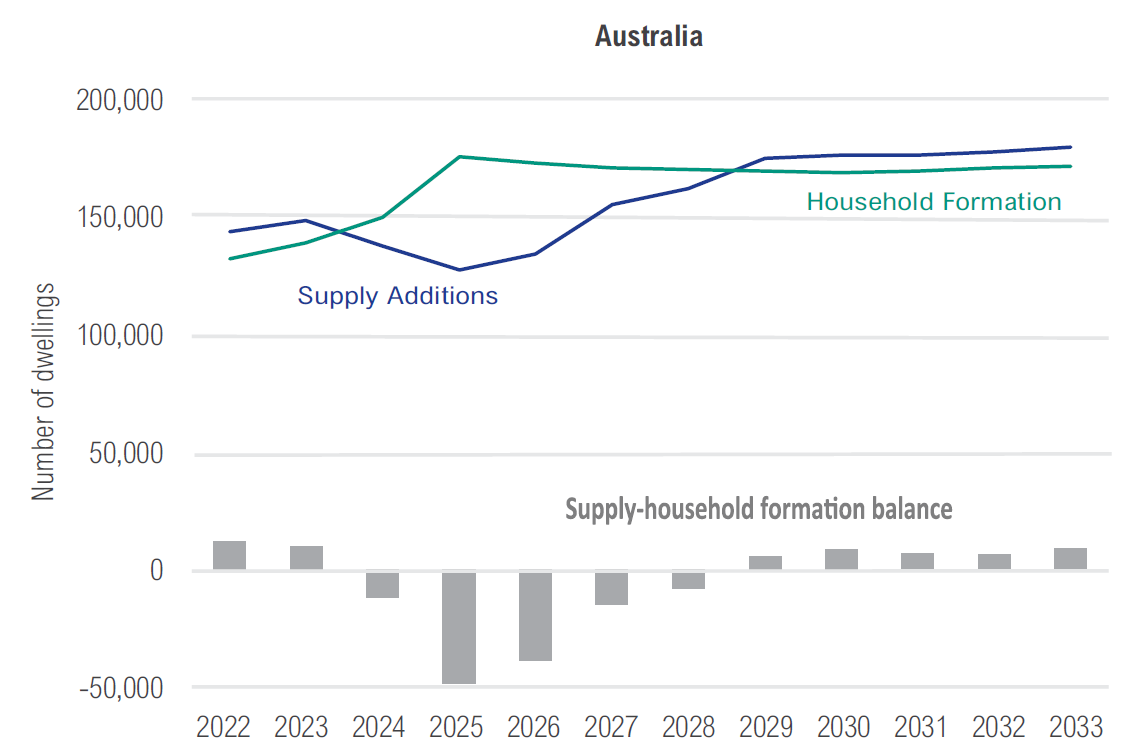

According to the National Housing Finance and Investment Corporation, the housing shortage is expected to persist until at least 2029, creating ongoing challenges for potential homeowners. Even if supply begins to catch up, it will take several years to address the accumulated undersupply.

Annual change in household formation and supply

Construction industry

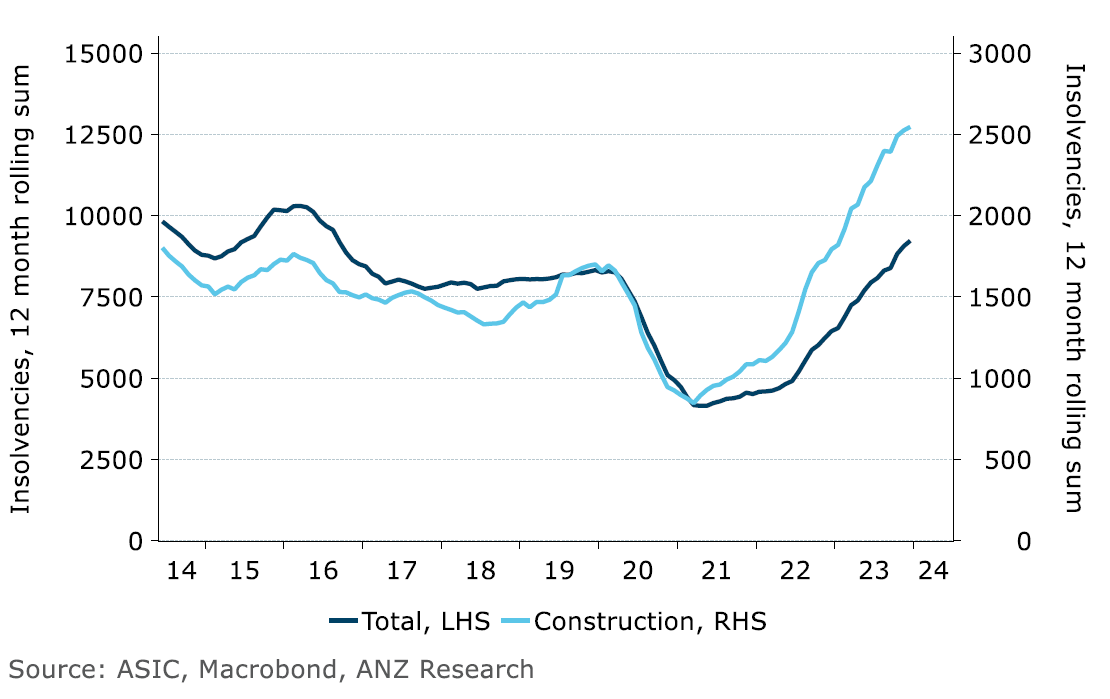

One of the reasons supply has struggled to meet demand is the state of the construction industry. The number of insolvencies in the industry has risen significantly, with no signs of slowing down, much less reversing.

Insolvencies – Construction industry vs. Overall

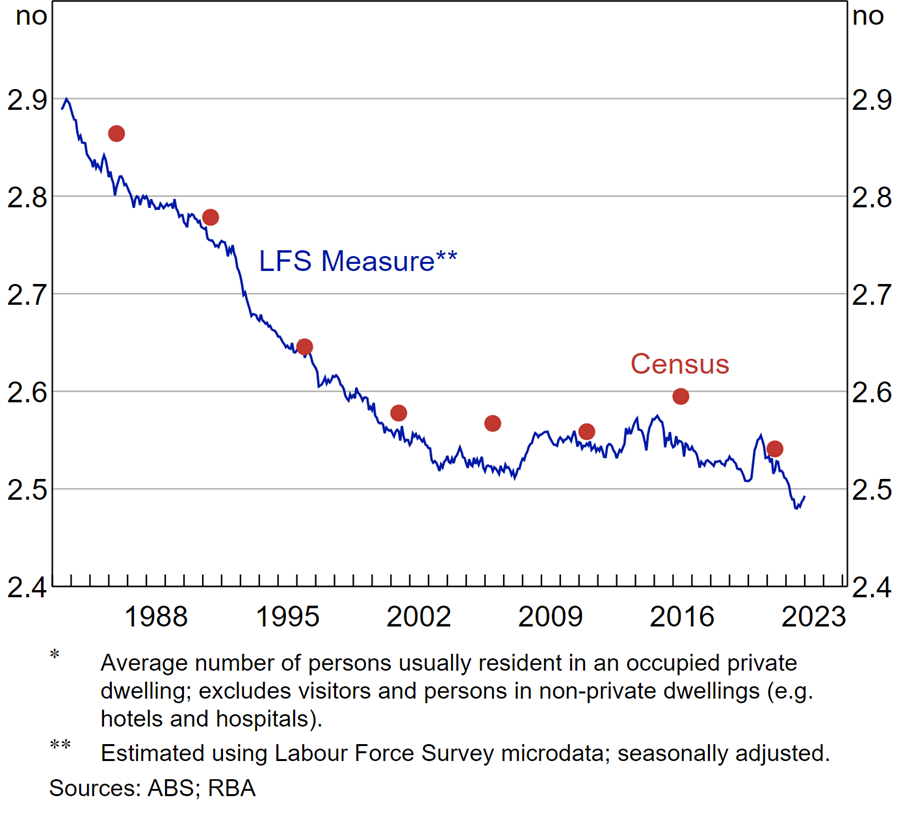

Household size

The average household size in Australia has consistently decreased over the last 30 years, dropping from 2.9 persons per household in 1983 to 2.5 persons. While this may seem minor, with a population of around 27 million, this difference has created demand for an additional 1.5 million dwellings. This equates to 300,000 more homes needed, on top of the 1.2 million planned for the next five years.

Average household size

Recent data shows that household size is still gradually declining. The reduction in household size from 2016 to 2023 alone necessitates nearly 300,000 new dwellings.

Recent trends in Average Household Size

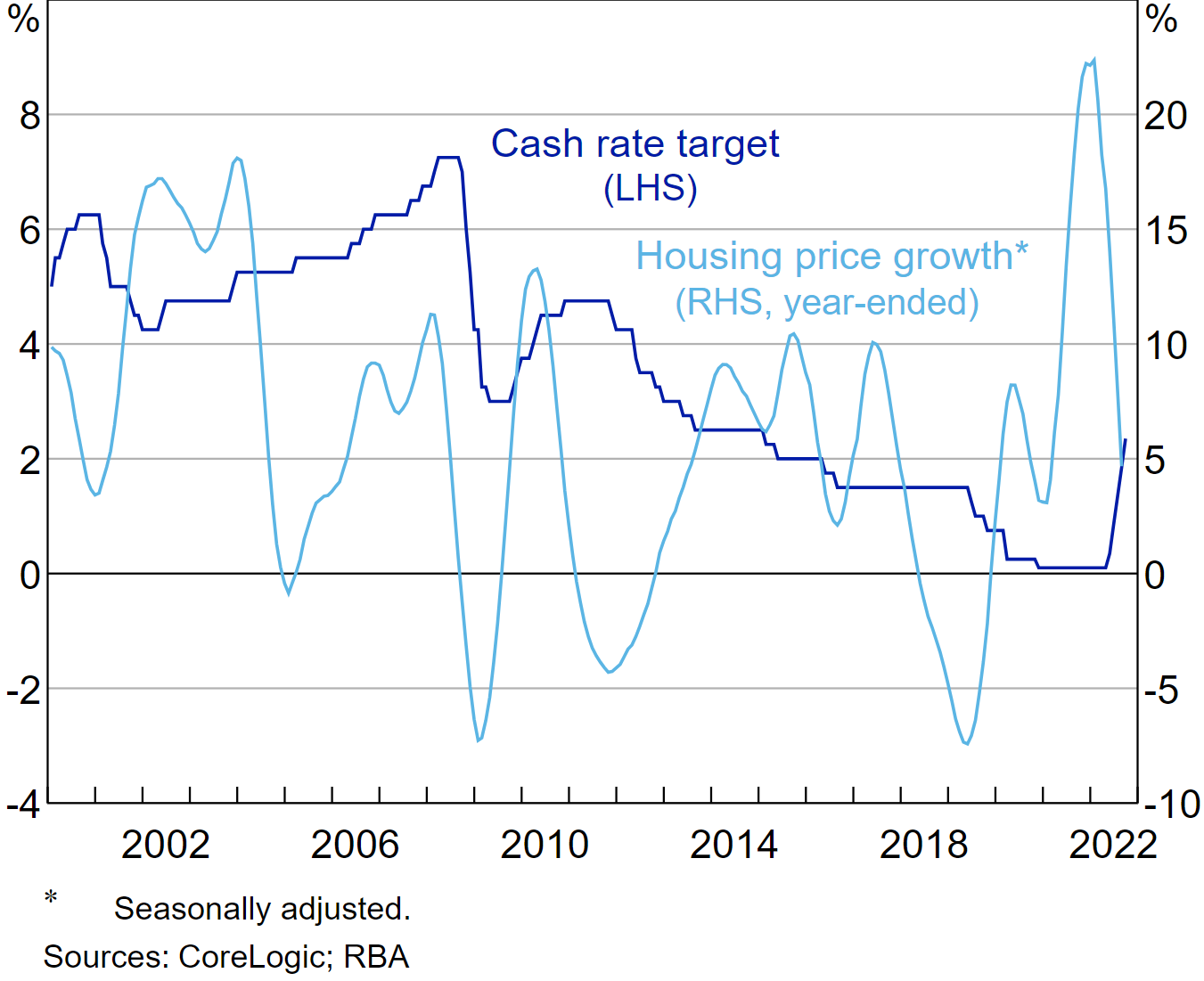

Interest Rates and Their Impact on Serviceability and Affordability

Historically, lower interest rates have increased loan affordability, making property prices more accessible and leading to price surges, particularly post-COVID. However, the opposite is not necessarily true. Property prices have continued to rise even during periods of high interest rates.

Interest Rates and Housing Prices

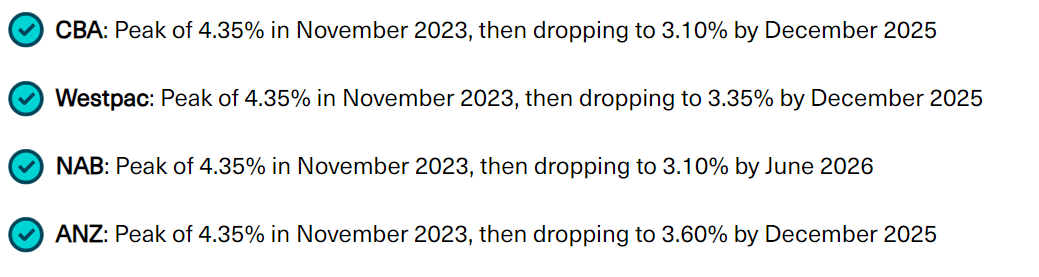

According to a recent ABC News article, "11 lenders have cut fixed rates, and five have cut their variable rates since the start of August. (Some lenders have done both for different products.)" These cuts are significant, with the Commonwealth Bank of Australia (CBA) reducing its fixed rate by up to 0.7 percentage points and its variable rates by up to 0.35 percentage points.

These rate cuts align with the major banks' forecasts for future interest rate trends. Lower interest rates increase affordability for larger loans, meaning property prices are unlikely to slow down.

Source: RateCity as of August 2024

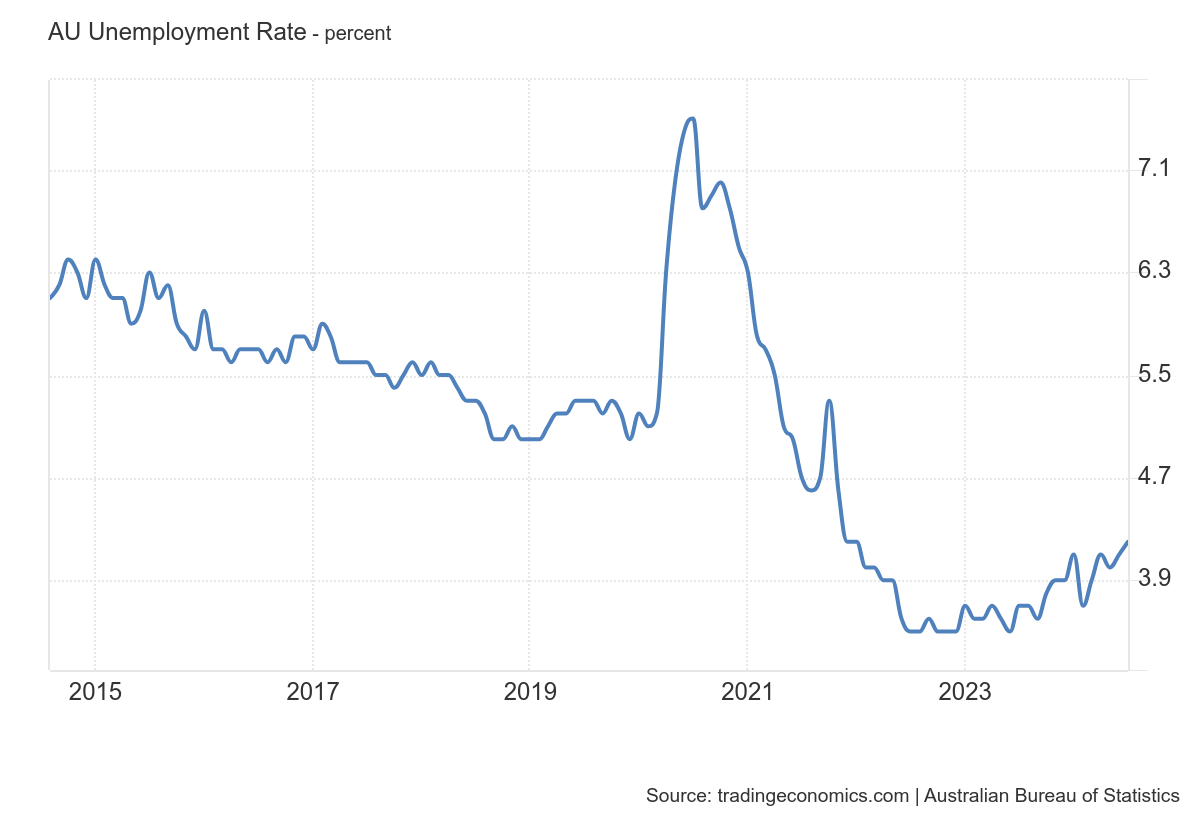

Economic strength

Despite negative media coverage of the economy, the unemployment rate remains low. Although it has been gradually rising since the last quarter of 2023, it is still below the Reserve Bank of Australia's (RBA) "full employment" threshold of 4.25% to 4.5%.

Annual Unemployment Rate

Annual GDP Growth

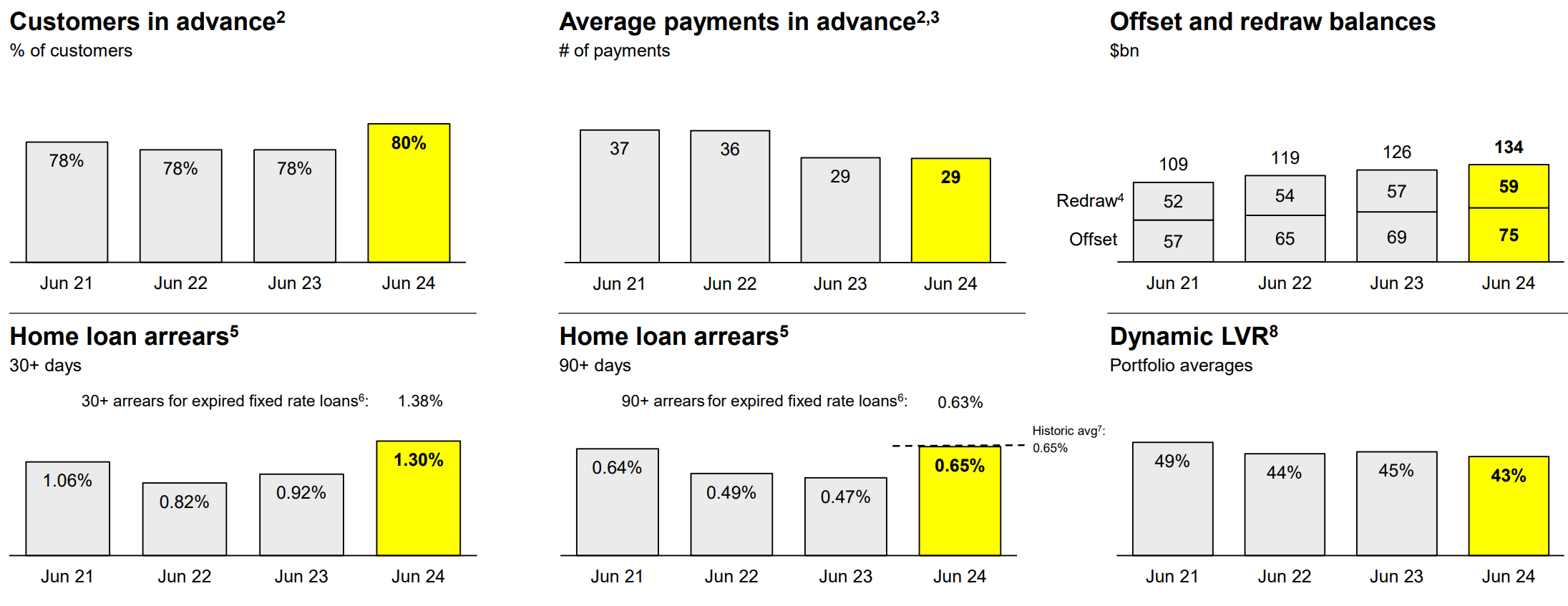

Based on the Commonwealth Bank of Australia's FY24 full-year results, the bank's home loan portfolio remains robust, with more customers ahead on loan repayments, higher offset and redraw balances, and 90+ day arrears at historic average levels. However, 30+ day arrears have seen an uptick.

CBA’s home loans resilience

Consumer Confidence

Consumer sentiment hit a historic low in 2023, comparable to the levels seen during the Global Financial Crisis (GFC) and the COVID-19 pandemic. Historically, property prices have rebounded following periods of low consumer confidence.

With expectations of interest rate cuts providing relief from cost pressures, consumer confidence is anticipated to improve in 2024 and beyond.

ANZ-Roy Morgan Consumer Confidence

While the ideal time to purchase property may have been a decade ago, 2024 still presents a strong opportunity to enter the market. This is due to factors such as the ongoing supply-demand imbalance, projected interest rate cuts from major banks, the economy's underlying strength, and a recent rise in consumer confidence.

We’re here to help

Interested? If you're like many property investors, you're probably wondering what's the right thing to do at present. Should you buy, should you sell, or should you just wait? Let us help you buy your next investment-grade property. Book an obligation-free consultation today.

Other helpful articles for your property journey that a buyer’s agent can assist you

Top 5 tips for selecting the right suburb to invest in

Guide to finding the right investment property

Buying an investment property through SMSF

The information contained in this article is intended to be of a general nature only. It has been prepared without taking into account any individual objectives, financial situation or needs. Before acting on this information, Premier Buyers recommends that you consider whether it is appropriate for your circumstances and engage qualified professionals.